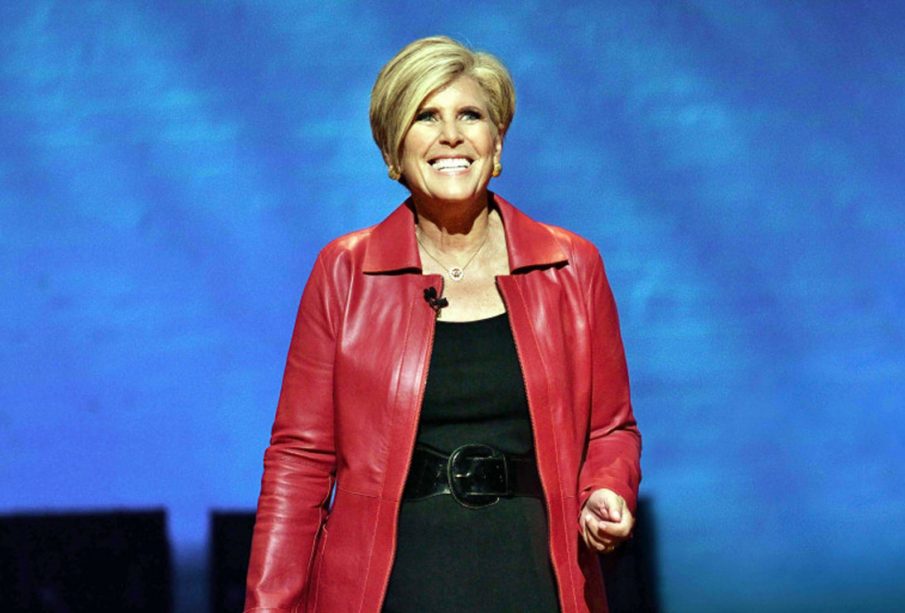

Suze Orman: Mortgage Refinancers Often Make a ‘Huge Mistake’

This year’s least expensive home loan rates of all time have had house owners rising to re-finance their loans and cut down their month-to-month payments, often by hundreds of dollars.

If you’re considering signing up with the rush to refi, individual financing author and TELEVISION personality Suze Orman desire you to stop briefly and take a deep breath– so you will not mishandle it.

“It makes me so insane how most house owners make a big mistake when they re-finance,” she states.

It’s an oversight Orman says can quickly saddle you with much greater interest expenses, even if you manage to land a mortgage rate your pals will covet.

‘So very wrong’

Home mortgage rates have plunged to new lows in 2020 as the coronavirus crisis has rattled investors and caused the Fed to slash the rate of interest almost to absolutely no to prop up the economy.

Low rates triggered nearly 1.7 million house owners to re-finance during this year’s April-through-June quarter alone– more than double the number who secured fresh loans during the exact same period in 2019, according to Attom Data Solutions.

Orman states the expensive mistake many of those recent refinancers most likely made was to instantly grab another 30-year home loan, even if they’d been paying down their existing 30-year loan for numerous years.

“This is so extremely incorrect,” she composes, in her blog site.

The individual financing guru states suppose you’d been paying for your original loan for 14 years, then got a brand-new 30-year home mortgage. “Sure, the brand-new home mortgage is at a lower rate of interest, however, you just extended your mortgage-payment on this house to 44 years!” she says.

When a 30-year refinance might make good sense

The 30-year fixed-rate home loan is America’s most popular home mortgage, so it may naturally be the go-to for property owners who wish to sell their current mortgages for a better offer.

And it’s the obvious choice if your present mortgage is relatively brand-new. Millions of individuals who financed their houses at the start of 2020– when 30-year mortgages were averaging around 3.75%– might save an average $299 by refinancing at today’s low rates, the home loan information firm Black Knight has approximated.

But, like lots of professionals, Orman typically advises refinancing to a brand-new loan with a shorter term.

Time Out Current Time 0:26/ Duration 2:57 Loaded: 77.31% Unmute 0 Fullscreen How you can conserve $1 million for retirement Click to expand

“My rule of refinancing is that you are to never extend your total repayment duration past 30 years,” she says in the blog.

Let’s say you are certainly still holding onto a 30-year loan you took 14 years back throughout the fall of 2006.

At that time, rates were balancing a stiff 6.4%. (Seriously, you need to have refinanced before now.) Say your home loan was originally in the quantity of $250,000; you’d now have a balance left of about $188,000.

Why consider re-financing into a shorter-term loan

Today, rates on 30-year fixed mortgage are balancing simply 2.87%, according to mortgage company Freddie Mac.

If you were to re-finance that $188,000 balance to a new 30-year home loan at 2.87% and remain with the loan for the entire term, the lifetime interest would total near$93,000.

You could select to do a 15-year refinance instead. Fifteen-year home loans have a lower rate of interest than 30-year loans: The average for a 15-year is presently simply 2.37%.

With a $188,000 15-year mortgage at 2.37%, you’d pay interest of simply approximately$35,600over the life of the loan. That’s $57,400 less than the 30-year refinance.

But numerous refinancers don’t select a 15-year loan because they don’t believe they can afford the greater payments:

- The monthly payment (principal plus interest) on a 30-year refi for $188,000 at 2.87% has to do with$780.

- The regular monthly payment (principal plus interest) on a 15-year refi of $188,000 at 2.37% is$1,242.

However, Orman says in the last few years 15-year mortgage rates have been so low “that you may be able to refinance your remaining balance and end up with a payment that is not much various than what you were paying on your 30-year.”

And in our example, it’s true:

- The monthly payment (principal plus interest) on the initial 30-year home mortgage of $250,000 at 6.4% was$1,563. The brand-new 15-year loan costs $321 less monthly.

How to pick

Whichever kind of mortgage you decide on for your refinance, you desire to feel particular you’re going to remain in the home a few years.

“There is no such thing as a complimentary refinance,” Orman says. “You will either pay closing costs– which can be a couple of portion points of your loan expense– or a higher rate of interest.”

Typical mortgage closing expenses now leading $5,700, according to data from ClosingCorp. You will not wish to move till after the cost savings from that brand-new, lower home mortgage rate of yours have paid off the closing costs– and after that some.

If you believe you remain in the home for the long run, refinancing into a 15-year mortgage can be the wise option, if you can deal with the payments. Your interest rate will be lower and you’ll pay 10s of thousands of dollars less in interest gradually.

Choosing another 30-year home loan and its lower monthly expenses can be the smarter move if you’re not likely to stay in your home long term. If you may be leaving within a couple of years, what does it matter if you have a 30- or a 15-year loan?

Before you pick any loan, always search. Get mortgage offers from a number of loan providers to find the very best rate offered in your location and for a person with your credit rating. Do not assume that the extremely first lending institution you struck up will provide you the most affordable rate possible.

Be sure to put your window shopping abilities to use when you get your renewal notice from your home insurance coverage business, too. You can quickly get several house insurance coverage quotes and compare rates, to discover what works best for you.