How could Money in Excel App Help Savers?

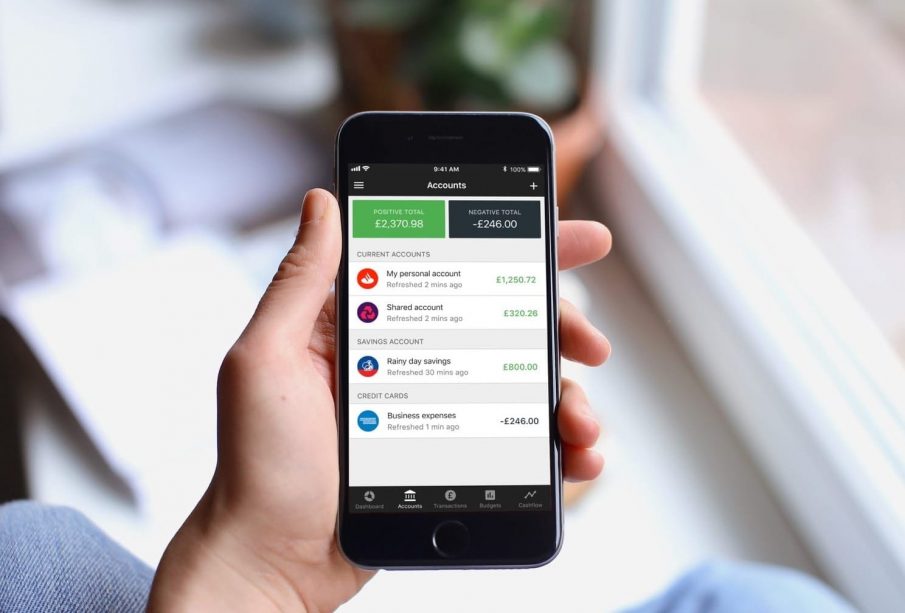

The financial services business Plaid has signed up with forces with Microsoft to develop an app, which lets its users import their banks and charge card declarations into the new personal financing tool. It is called ‘Money in Excel’. So far, the application itself is offered to the Microsoft 365 subscribers just. However, it is also possible that after a long time this app can become available to a large audience.

Plaid is mostly focused on bank information sharing, its applications let users import the deals on their bank accounts. Visa has acquired this business as an outcome of a $5.3 billion deal.

So why can this app work for consumers? Well, there are many people not only in the U.S.A. but also in other nations in general who are imagining getting out of debt and in the long term achieving financial security.

To get that point, numerous famous personal financing coaches like Dave Ramsey and Suzie Orman suggest taking control of their spending habits and either keep a journal where they might record all of their expenses or alternatively use some kind of software or a mobile application for this function.

Dave Ramsey has even created so-called ‘7 infant actions’. The first step is to save $1,000 in an emergency fund when the second one focuses on paying off all arrearages other than the mortgage. Undoubtedly, attaining any of those is unrealistic, unless one takes control of individual financial resources and begins conserving cash.

This is the reason creating a spending plan might be necessary for controlling expenses, therefore recording all of the expenditures can be useful in getting some idea about each spending category.

Using excel can be one method to attain that, nevertheless, due to the fact that it is viewed as being a technically complicated program, the bulk of consumers have an expectation, that it has lots of intricate formulas and without a major knowledge of IT, one might not utilize it.

This current Plaid-Microsoft offer aims to ease those issues and make making use of stand out more simplified for normal clients.

Tracking Online Income Streams

This brand-new application can likewise assist customers to track online profits streams. For instance, there are numerous Forex and CFD traders, who are utilizing the mt4 platform or other platforms and have additional profits streams from those activities. The typical trader can have regular deposits and withdrawals from his or her trading account to the bank account, so often it may be really time taking in to make a note of every single transaction and create earnings.

This application can streamline this procedure, where a customer can have all of the current deposits and withdrawals on one page on excel and make computations with just one mouse click.

New Personal Financing Tool

Most personal finance experts recommend that the method to improve personal monetary standing is to minimize spending and save a bigger portion of the income. When it pertains to this every popular economist has various opinions, however numerous of them, consisting of Bloomberg publishers, concur that it is best to conserve early and automatically.

How can this be possible? Rationally one needs to cut costs in order to clear space for some cost savings. Basically, there are two ways to track expenditures. The traditional option is to get an actual journal and record all day-to-day purchases there. However, this may have several problems:

- It is easy to forget the actual amount of transactions, particularly if the consumer has gone to a number of shops as soon as.

- Recording all transactions in a journal and summing up the total quantity can be inconvenient and one can easily provide up after some days of trying,

- After some months of recording, the consumer needs to transfer all the information from this journal to excel or at least use the calculator and some formula to come up with the average regular monthly costs and portion modifications.

All those things discussed above can make the whole procedure more complicated than it needs to be and as a result, it is simple to lose motivation.

On the other hand, if the consumer utilizes just his/her credit/debit card for all transactions, then it can be automatically tape-recorded in the bank declaration. Without the requirement of filling some monetary journals, the client can simply log in to electronic banking and get all of the costs at a look.

For that reason, this most current monetary application can simplify the use of stand out and could possibly make the recording and evaluating one’s expenditures easier.

The most essential advantage of this brand-new application is that If a consumer wishes to decrease costs and conserve more cash for a house purchase or investing than she or he can examine each classification of costs, identify if there is any excess and make the subsequent changes without spending hours in front of a calculator and journal.

There are lots of people who have an interest in enhancing their financial future, who are tired of living income to paycheck, nevertheless, the complexity of calculating expenditures and constructing a budget plan presses them far from taking the essential steps. Therefore, applications like Cash in Excel can assist customers to streamline the whole process and make budgeting more available.